Page 26 - Apraava Energy Report_01-73

P. 26

26 Energy in action

Effective corporate governance is an imperative for Robust and good governance

the long-term growth of Apraava Energy. Our

philosophy of corporate governance is guided by our policies are required to achieve

commitment to protect the rights of stakeholders,

manage risks and create long-term value for all. optimised and sustainable energy

Our robust corporate governance framework, along generation. At Apraava, we try to

with our unparalleled services, has enabled us to earn

the trust of people and businesses across India in implement standardised principles

making the energy transition and becoming more

sustainable. Apart from ensuring a strong and and governing rules to reduce our

balanced relationship with our employees, customers,

business partners and other stakeholders, the environmental impacts through

governance framework seeks to uphold the highest,

unwavering standards of transparency, responsible energy generation,

accountability and independence.

Supply Chain Managament (SCM),

Shareholder Value waste management and resource

At Apraava Energy, we recognise the impact of our efficiency.

business pursuits on environment and community.

Hence, we take measures to safeguard the interests

of our shareholders by empowering them with

knowledge on how we create sustainable value by Apraava Energy is a

utilising intellectual, financial, manufactured, natural,

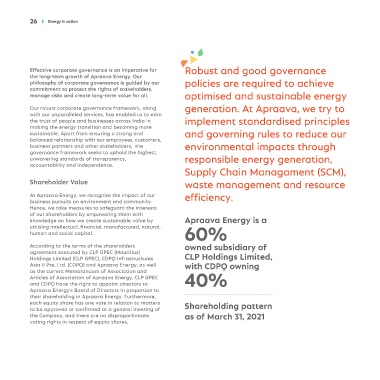

human and social capital. 60%

According to the terms of the shareholders owned subsidiary of

agreement executed by CLP GPEC (Mauritius)

Holdings Limited (CLP GPEC), CDPQ Infrastructures CLP Holdings Limited,

Asia II Pte. Ltd. (CDPQ) and Apraava Energy, as well with CDPQ owning

as the current Memorandum of Association and

Articles of Association of Apraava Energy, CLP GPEC 40%

and CDPQ have the right to appoint directors to

Apraava Energy's Board of Directors in proportion to

their shareholding in Apraava Energy. Furthermore,

each equity share has one vote in relation to matters Shareholding pattern

to be approved or confirmed at a general meeting of

the Company, and there are no disproportionate as of March 31, 2021

voting rights in respect of equity shares.