Page 234 - 1-37

P. 234

TRANSFORMING TRANSFORMING TRANSFORMING

SUSTAINABILITY REPORT FY 2023 COMMUNITIES THE PLANET THE WORKPLACE

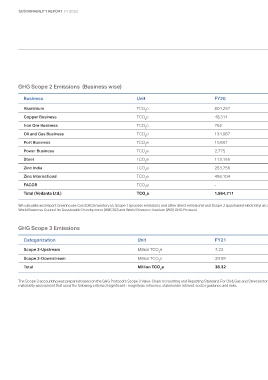

GHG Scope 2 Emissions (Business wise)

Business Unit FY20 FY21 FY22 FY23

Aluminium TCO e 804,257 519,576 2,117,489 5,994,336

2

Copper Business TCO e 48,314 65,227 73,079 87,924

2

Iron Ore Business TCO e 762 1,536 593 3,805

2

Oil and Gas Business TCO e 134,987 142,325 254,143 344,655

2

Port Business TCO e 10,601 8,318 10,237 7,588

2

Power Business TCO e 2,775 8,128 1 -

2

Steel TCO e 113,155 95,963 143,321 249,986

2

Zinc India TCO e 253,756 307,059 497,965 1,135,622

2

Zinc International TCO e 496,104 164,686 235,053 249,700

2

FACOR TCO e - - 10,864 106,915

2

Total (Vedanta Ltd.) TCO e 1,864,711 1,312,818 3,342,745 8,182,542

2

We calculate and report Greenhouse Gas (GHG) inventory i.e. Scope 1 (process emissions and other direct emissions) and Scope 2 (purchased electricity) as defined under the

World Business Council for Sustainable Development (WBCSD) and World Resource Institute (WRI) GHG Protocol.

GHG Scope 3 Emissions

Categorization Unit FY21 FY22 FY23

Scope 3-Upstream Million TCO e 7.23 8.04 8.58

2

Scope 3-Downstream Million TCO e 29.09 29.37 29.61

2

Total Million TCO e 36.32 37.41 38.19

2

The Scope 3 accounting was prepared based on the GHG Protocol’s Scope 3 Value-Chain Accounting and Reporting Standard. For Oil & Gas and Steel sectors, sector specific standards were used. To determine, which of the 15 upstream and downstream categories were relevant for our business, we conducted a

materiality assessment that used the following criteria of significant - magnitude, influence, stakeholder interest, sector guidance and risks.

118