Page 17 - Apraava Energy Report_01-73

P. 17

Apraava Sustainability Report 2020-2021 17

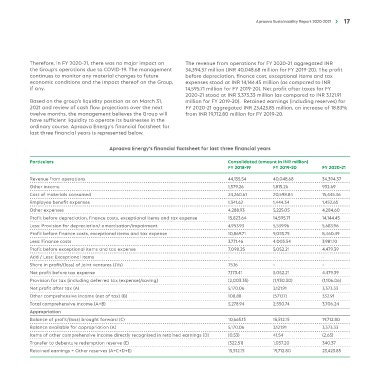

Therefore, in FY 2020-21, there was no major impact on The revenue from operations for FY 2020-21 aggregated INR

the Group’s operations due to COVID-19. The management 34,394.37 million (INR 40,048.68 million for FY 2019-20). The profit

continues to monitor any material changes to future before depreciation, finance cost, exceptional items and tax

economic conditions and the impact thereof on the Group, expenses stood at INR 14,144.45 million (as compared to INR

if any. 14,595.71 million for FY 2019-20). Net profit after taxes for FY

2020-21 stood at INR 3,373.33 million (as compared to INR 3,121.91

Based on the group's liquidity position as on March 31, million for FY 2019-20). Retained earnings (including reserves) for

2021 and review of cash flow projections over the next FY 2020-21 aggregated INR 23,423.85 million, an increase of 18.83%

twelve months, the management believes the Group will from INR 19,712.80 million for FY 2019-20.

have sufficient liquidity to operate its businesses in the

ordinary course. Apraava Energy’s financial factsheet for

last three financial years is represented below.

Apraava Energy’s financial factsheet for last three financial years

Particulars Consolidated (amount in INR million)

FY 2018-19 FY 2019-20 FY 2020-21

Revenue from operations 44,135.54 40,048.68 34,394.37

Other income 1,579.26 1,815.26 932.69

Cost of materials consumed 24,260.61 20,598.84 15,445.36

Employee benefit expenses 1,341.62 1,444.34 1,452.65

Other expenses 4,288.93 5,225.05 4,284.60

Profit before depreciation, finance costs, exceptional items and tax expense 15,823.64 14,595.71 14,144.45

Less: Provision for depreciation/ amortisation/impairment 4,953.93 5,539.96 5,683.96

Profit before finance costs, exceptional items and tax expense 10,869.71 9,055.75 8,460.49

Less: Finance costs 3,771.46 4,003.54 3,981.10

Profit before exceptional items and tax expense 7,098.25 5,052.21 4,479.39

Add / Less: Exceptional items - - -

Share in profit/(loss) of joint ventures (JVs) 75.16 - -

Net profit before tax expense 7,173.41 5,052.21 4,479.39

Provision for tax [including deferred tax (expense)/saving] (2,003.35) (1,930.30) (1,106.06)

Net profit after tax (A) 5,170.06 3,121.91 3,373.33

Other comprehensive income (net of tax) (B) 108.88 (571.17) 332.91

Total comprehensive income (A+B) 5,278.94 2,550.74 3,706.24

Appropriation

Balance of profit/(loss) brought forward (C) 10,665.13 15,512.15 19,712.80

Balance available for appropriation (A) 5,170.06 3,121.91 3,373.33

Items of other comprehensive income directly recognised in retained earnings (D) (0.53) 41.54 (2.65)

Transfer to debenture redemption reserve (E) (322.51) 1,037.20 340.37

Retained earnings + Other reserves (A+C+D+E) 15,512.15 19,712.80 23,423.85